Why do corporations pay lower tax rates?

Small businesses in Canada pay very low rates of tax on their income. That’s a positive thing, because after submitting your tax return, that extra...

3 min read

Mike McLenehan Apr 20, 2020 1:00:00 PM

Do you use a home office for earning employment or business income? Claiming home office expenses on your tax return is going to reduce your taxable income and save you money.

If you have a home office simply take the square footage of your workspace and divide it by the total square footage of your house to determine the percentage of home expenses which would be deductible for income tax purposes.

For example, if your home office is 100 square feet (10 feet by 10 feet) and your whole home is 1000 square feet (25 feet by 40 feet) then 10% of your home expenses would be eligible as a deduction (100 square feet divided by 1000 square feet is 0.10 or 10%).

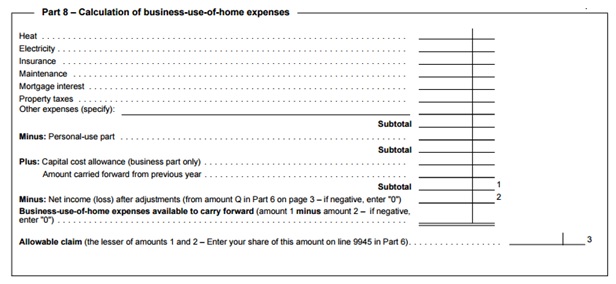

Depending on whether you are employed or self-employed you can claim a portion of the following expenses each year:

|

|

Employee |

Employee, With Commissions |

Self-Employed or Corporate Business Owner |

|

Rent expense (if renting) |

Yes |

Yes |

Yes |

|

Electricity, heat, and water |

Yes |

Yes |

Yes |

|

Repairs and maintenance |

Yes |

Yes |

Yes |

|

Property taxes |

No |

Yes |

Yes |

|

Home Insurance |

No |

Yes |

Yes |

|

Mortgage Interest |

No |

No |

Yes |

Apply the business-use-of-home percentage calculated above to the total of home expenses for the year from the categories listed above to determine the allowable claim for business-use-of-home expenses.

Additional benefit for corporate business owners

Claiming business-use-of-home benefits corporate business owners by reducing your personal taxable income for the year.

Business-use-of-home expense is charged against your shareholder loan account (as though you made a loan to your corporation by paying for its share of these expenses). This reduces your shareholder loan balance for the year and the amount of the salary/dividend that you will reflect on your personal income tax return.

In addition to you being able to withdraw tax-free dollars from your corporation the corporation itself receives a tax deduction for the home expenses it is reimbursing you for.

A few criteria to meet for expenses to be eligible

Subsection 8(13) and subsection 18(12) of the Income Tax Act provide two criteria which need to be met for a portion for your home expenses to be deductible:

Home office expenses can be claimed to the extent that they reduce your income from employment or business to NIL. If claiming your home office expenses would result in a loss those losses are carried forward indefinitely and applied against taxable income in a future year from the same source of income.

Additional requirement for employees

For employees it must be required by an employment contract that the employee maintain a workspace in his/her home as a condition of employment.

Your employer must complete for you form T2200 Declaration of Conditions of Employment which you will keep on file and submit to Canada Revenue Agency should it ever be requested from you.

For more information about deductions for employees, see T4044 Employment Expenses.

Small businesses in Canada pay very low rates of tax on their income. That’s a positive thing, because after submitting your tax return, that extra...

There are many tax advantages for self-employed Canadians who work from home and hire family members in their business.

The Lifetime Capital Gains Exemption (LCGE) allows Canadian incorporated small business owners to claim a deduction when selling shares of a...