| Fractional CFO | Fractional Controller | Fractional Accountant | |

|---|---|---|---|

| Average Weekly |

Paid Weekly Average |

Paid Weekly Average |

Paid Weekly Average |

| Comparing Average Full-Time Salaries | |||

| Full-Time CFO | |||

| Full-Time Controller | |||

| Full-Time Accountant | |||

| Annual Savings | |||

| Savings % | |||

| Advisory | |||

| Online Financial Dashboards | |||

| Monthly Financial Performance Reports | |||

| Monthly Financial Performance Meeting | |||

| 12-Month Future Forecasting | |||

| Monthly Financial Forecast Meeting | |||

| Unlimited Advisory Support | |||

| Key Performance Indicator (KPI) Tracking | |||

| Cash Flow and Profitability Reports | |||

| Weekly Cash Flow Management | |||

| Monthly Cash Flow and Profit Improvement Meeting | |||

| Revenue and Sales Pipeline Reports | |||

| Monthly Revenue and Sales Pipeline Meeting | |||

| Employee Incentive Plans | |||

| Mergers and Acquisitions Planning | |||

| Exit Planning | |||

| Leadership or Board Meetings | |||

| Accounting | |||

| Accounting Transactions (Daily Data Entry) | |||

| Bank Account Reconciliations | |||

| Credit Card Reconciliations | |||

| Quality Assurance Review | |||

| Daily Financial Update Email | |||

| Real Time Communication | |||

| Sales Tax Filings | |||

| Payroll Administration | |||

| Employee Spend Management | |||

| Job Profitability Tracking and Reports | |||

| Accounts Payable and Bill Payments | |||

| Accounts Receivable and Customer Chasing | |||

| Tax Preparation and Planning | |||

| Compilation Financial Statements and Corporate Tax Preparation | |||

| Personal Tax Preparation | |||

| Owner Tax Planning | |||

Fractional CFO Services

Get financial clarity and strategy without a full-time CFO.

McLenehan and Associates CPAs provides CFO-level financial leadership to business owners just like you—delivering clarity, strategy, and peace of mind through our structured advisory process.

Free Initial Consultation

Fractional CFO Discovery Call

Feeling uncertain about your numbers or next financial move? Book a free meeting to explore how our CFO guidance can help you improve cash flow, increase profitability, and make confident decisions.

Most business owners aren’t struggling with business — they’re struggling with the numbers.

Even successful companies can feel financially out of control. You’re growing, but every decision starts to feel like a guess. Without clear insight into performance, profitability, and cash flow, it’s easy to lose sleep wondering what you’re missing.

Common challenges we see:

-

Cash in the bank, but no idea where it’s going

-

Uncertainty around pricing, hiring, or expansion decisions

-

A growing business that’s outpaced internal systems

-

Bookkeepers and accountants who focus only on the past

-

No forecast, no plan, and no time to figure one out

-

A constant sense of financial anxiety or “flying blind”

Our Fractional CFO service changes everything — bringing structure, strategy, and clarity to your finances so you can lead with confidence.

Fractional CFO Services

With Strategic Insight Comes Clarity and Confidence

At some point, every business outgrows gut instinct. You know the moment — when questions about cash flow, pricing, or hiring start piling up, and you’re no longer confident in the numbers guiding your decisions.

Our CFOs work with you to bring structure, insight, and clarity to your financial strategy. We translate your data into forecasts, help you plan for what’s ahead, and guide key decisions with confidence.

The result? Less stress, stronger profits, and a business that runs on clarity — not chaos.

Financial Clarity is a Competitive Advantage

When business owners gain access to CFO-level guidance, everything changes. Instead of reacting to problems, they lead with purpose, backed by numbers they understand and trust.

Here’s what working with a Fractional CFO makes possible:

-

Clarity on where your business stands and where it’s headed

-

Confidence in key decisions like pricing, hiring, and investment

-

Proactive cash flow planning — no more surprises

-

Stronger profit margins through better financial strategy

-

Less stress and more time to focus on growing the business

-

Ongoing support from a financial partner who knows your company inside and out

These benefits aren’t theoretical — they’re built into every part of our Fractional CFO service, delivered through structured monthly meetings, real-time reporting, and expert financial leadership.

CLIENT TESTIMONIAL

"Fractional CFO services have transformed our business."

Through our Fractional CFO service, we introduced daily reporting, structured monthly meetings, and on-demand support. The result? Our client shifted from reactive decision-making to leading with confidence and clarity. Today, their team is free to focus on what they do best, backed by a financial strategy that scales.

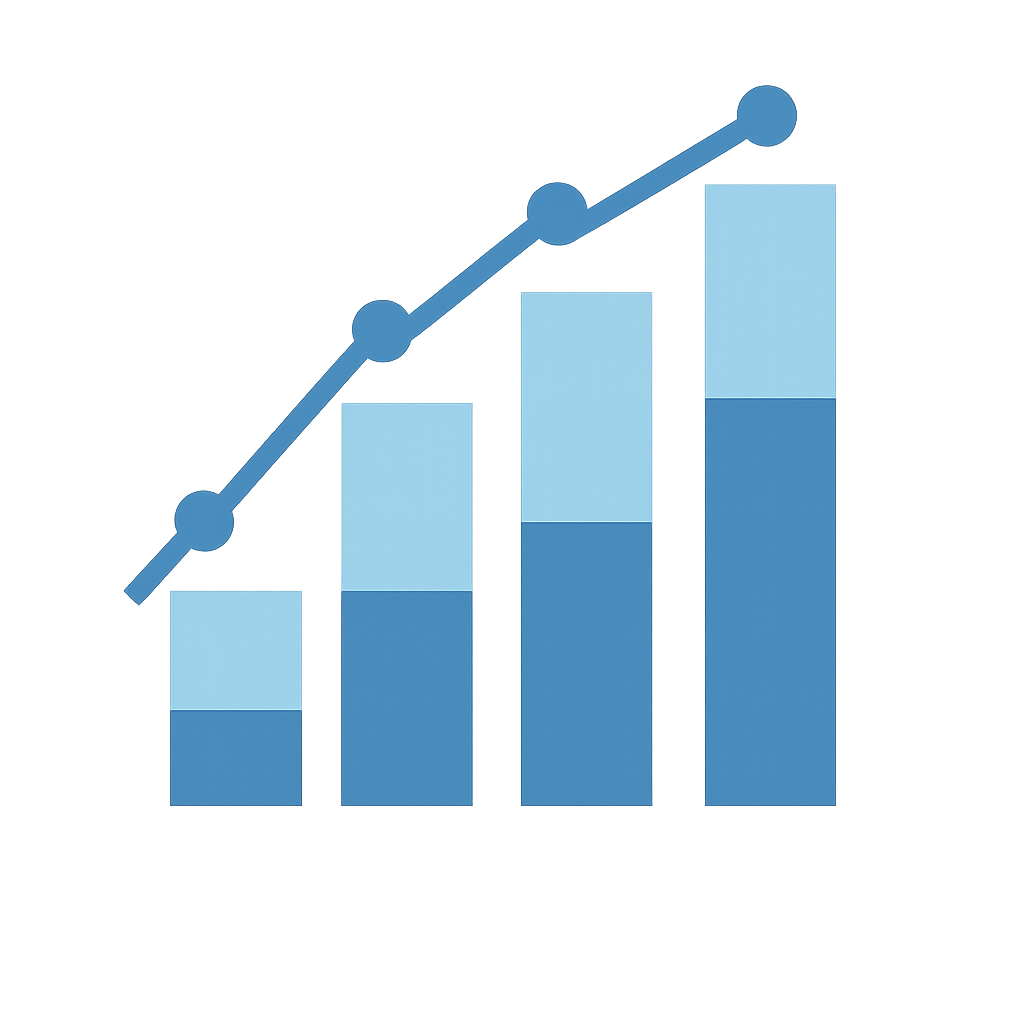

CHOOSE THE RIGHT SERVICE LEVEL

Choose the right service level of based on your company’s gross revenue, team size, and financial needs.

Fractional CFO

Strategic Financial Leadership for Companies at Scale

Designed for clients focused on reaching defined business objectives—be it scaling for growth, enhancing cash flow, or planning an exit. The Fractional CFO delivers strategic insight and guidance to unify sales, operations, and finance, driving alignment and sustained success across the entire organization.

Average Price: $1750/week

Fractional Controller

Financial Forecasting, Oversight and Actionable Reporting

Ideal for clients who need dependable financial oversight, accurate reporting, and basic forecasting support—without requiring ongoing strategic planning. This service provides financial management and reliable records to support clear visibility, proactive planning, and informed business decisions.

Average Price: $1250/week

Fractional Accountant

Daily Management of Core Financial Operations

Built for clients with in-house expertise and strategic oversight who require extra support managing daily financial operations. This service delivers the hands-on capacity needed to perform transactional accounting tasks with consistency, efficiency, and a high standard of accuracy.

Average Price: $900/week

Flexible and Transparent Pricing

Every proposal is tailored to your business — we’ll add or remove services as needed to build a plan that fits exactly what you need

(and nothing you don’t).

Getting Started Is Easy

You're just a few steps away from a firm quote, customized to your service level, optional add-ons, and business needs.

STEP 1: REQUEST A MEETING

Getting started is simple. Just click the "Request a Meeting" button on this page and fill out a short form with your contact information. You’ll have the chance to briefly describe your business, outline any specific needs, and let us know which service level you’re interested in exploring.

STEP 2: RECEIVE A PROPOSAL

Next, you’ll meet with one of our Fractional CFOs to discuss your business, your goals, and the challenges you're facing. Together, we’ll build a customized proposal with the right mix of services and optional features — designed to meet your needs and nothing more.

STEP 3: LET'S GET STARTED

Once you’re ready to move forward, we’ll begin our structured onboarding process. Over the next 4–8 weeks, our team will integrate with your business, gradually taking over the financial responsibilities outlined in your proposal — so you can focus on leading your company with clarity and confidence.

Free initial Consultation

Fractional CFO Discovery Call

Book a free meeting to explore how our CFO guidance can help you improve cash flow, increase profitability, and make confident decisions.

FREQUENTLY ASKED QUESTIONS

A Fractional CFO provides high-level financial strategy, planning, and oversight on a part-time or contract basis. They assist with budgeting, forecasting, cash flow management, financial reporting, and strategic decision-making to help businesses grow sustainably.

While accountants and bookkeepers focus on recording and reporting past financial transactions, a Fractional CFO looks forward, providing strategic insights and financial planning to drive future growth and profitability.

Fractional CFO services are ideal for small to mid-sized businesses that need strategic financial guidance but don't require a full-time CFO. If you're experiencing growth, facing financial complexity, or planning significant changes, a Fractional CFO can add substantial value.

Costs vary based on the scope of services and time commitment but are typically more affordable than hiring a full-time CFO. Many businesses find that the strategic insights and efficiencies gained provide a strong return on investment.

If you're facing challenges like cash flow issues, rapid growth, lack of financial clarity, or preparing for investment or acquisition, a Fractional CFO can provide the expertise needed to navigate these complexities.

Experienced Fractional CFOs often have diverse backgrounds across multiple industries. They quickly adapt to your business's unique needs and bring best practices that can be tailored to your specific industry context.

The level of involvement is customized to your needs. Some businesses require ongoing weekly support, while others may need assistance on a project basis. The engagement is flexible and can scale with your business.

Deliverables may include financial reports, cash flow forecasts, budgeting plans, strategic financial advice, and performance dashboards. These tools provide clarity and support informed decision-making.

Many businesses see immediate benefits from improved financial clarity and strategic planning. The onboarding process is designed to quickly identify key areas where the CFO can add value.

Begin with a consultation to discuss your business's needs and challenges. This conversation will help determine how a Fractional CFO can support your goals and outline the next steps for engagement.